James Real Estate RE Fin Terms Dnvr 2000 3rd Qtr Page 6

6

Sources: Barron's - John B. Levy and Company in "National Real Estate Investor", Federal Reserve Bank of New York, and The

Genesis Marketing Group

Average maturities of commercial loans vary broadly, however they are concentrated in the seven

to ten year range. The unweighted mean debt coverage ratios of ACLI's surveyed commitments for the

first quarter of 2000 was 1.47 for apartments, 1.55 for office buildings, 1.47 for retail and 1.31 for

industrial. Unweighted mean loan to value ratios are 68.8% for apartments, 67.3% for office buildings,

69.9% for retail and 71.9% for industrial.

The American Council of Life Insurance (ACLI) prepares a report on mortgage commitments

made each quarter greater than $100,000. A summary of average rates associated with each property type

is shown on the following page.

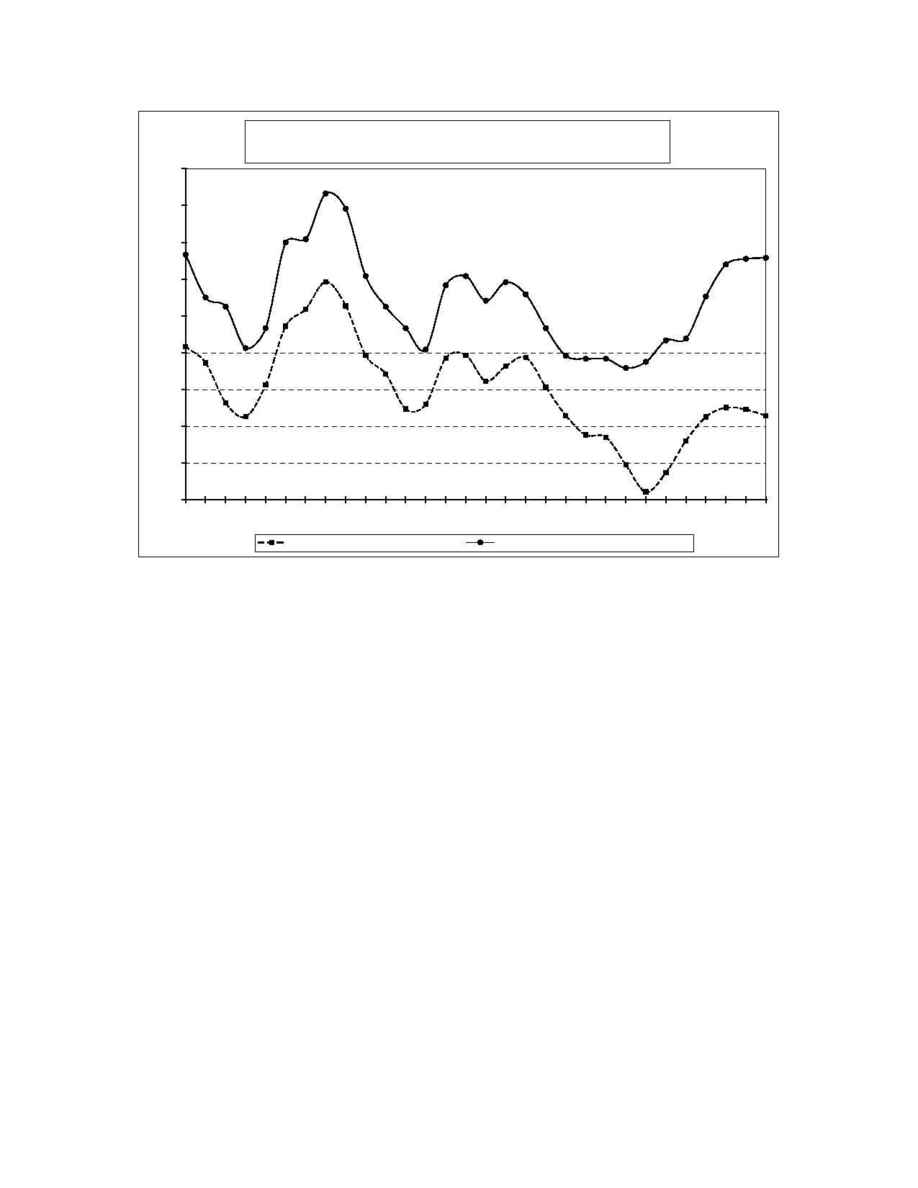

Government Bond - Commercial Mortgage Interest Rate Comparisons

Quarterly Averages - 1993 through Second Quarter 2000

5.0%

5.5%

6.0%

6.5%

7.0%

7.5%

8.0%

8.5%

9.0%

9.5%

1/93 2/93 3/93 4/93 1/94 2/94 3/94 4/94 1/95 2/95 3/95 4/95 1/96 2/96 3/96 4/96 1/97 2/97 3/97 4/97 1/98 2/98 3/98 4/98 1/99 2/99 3/99 4/99 1/00 2/00

Quarter/Year

Yi

el

d

o

r

I

n

ter

est Rate

30-Year U.S. Government Bond Yield

Prime 7-Year Commercial Mortgage Rate